Step MA Scalping

Submit by Richiard 21/02/2017

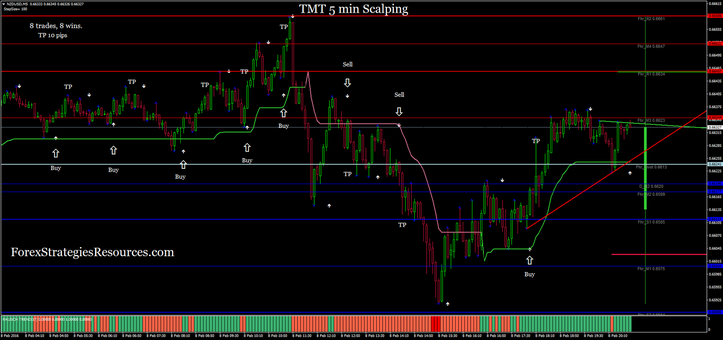

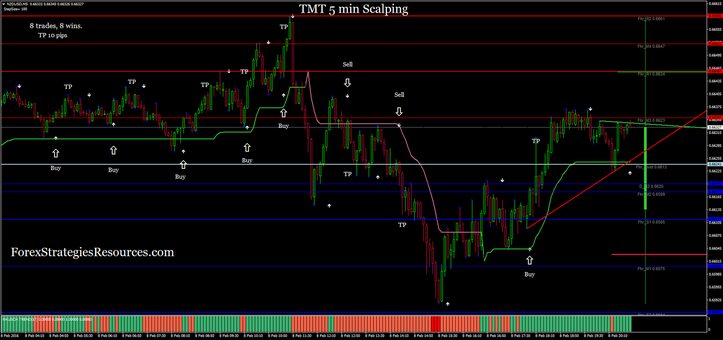

TMT 5 min Scalping is a pure trend following system for intraday trading. This is a (HFT ) High Frequency Trading system. This is a complex strategy based on more trend following indicators.

Time Frame 5 min.

Currency pairs: Major and Indices (Dax, S&P 500, Dow, FTSE).

Session: London and New York.

Avoid trading 30 Minutes before and after Major News.

Metatrader Indicators:

Daily Candle ( show the daily trend),

Trend Arrows,

Pivot points levels (as support and resistance or exit point),

De Mark Trend line Trader,

Step MA default setting (this indicator indicates the direction of the market);

Raush trend (17 period, overbougth level 70, oversold 30).

Trading rules TMT 5 min Scalping

Buy

1. Daily candle is green;

2. Arrow buy;

3. Step MA line green;

4. Raush trend green bar;

5. Wait for price to break above trendline and bar is closed (optinal);

6. Set your targets and stop loss.

Sell

1. Daily candle is green;

2. Arrow buy;

3. Step MA line green;

4. Raush trend green bar;

5. Wait for price to break above trendline and bar is closed (optinal);

6. Set your targets and stop loss.

Sell

1. Daily candle is red;

2. Arrow sell;

3. Step MA line red;

4. Raush trend red bar

5. Wait for price to break below trendline and bar is closed (optional);

6. Set your targets and stop loss.

Stoploss & Takeprofit

Set initial stop loss 3 pips above/below the Step MA line.

2. Arrow sell;

3. Step MA line red;

4. Raush trend red bar

5. Wait for price to break below trendline and bar is closed (optional);

6. Set your targets and stop loss.

Stoploss & Takeprofit

Set initial stop loss 3 pips above/below the Step MA line.

Fast Profit Target predetermined (example 10 pips EUR/USD, 9 pips AUD/USD, USD/CHF, 12 pips GPP/USD)

Risk Reward can vary from 1:0.8 to 1:25

Risk Reward can vary from 1:0.8 to 1:25

In the pictures TMT 5 min Scalping in action.

0 comments:

Post a Comment