Martingale Trading

Submit by Janus Trader 22/02/2017

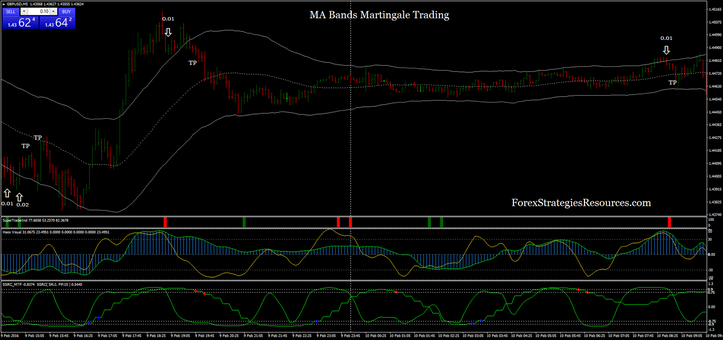

MA Bands Martingale Trading is an trend reversal strategy. This strategy have two reversal indicators.

Time Frame 5 min.

Currency pairs with low spreads not and Indices.

Apply this strategy at least on 4 currency pairs.

Metarader Indicators

MA Bands (MA period 56, ATR period 50, ATR multiplier 2.5:);

Super Trader Indi,

Haos visual mode

SSRC MTF (15 min) with SSRC.

Trading rules MA Bands Martingale Trading

Buy

When the price broken the lower band, wait the green bar of super trader indicator confirmed by Haos visual with yellow line above green line or confirmed by SSRC above SSRC MTF.

Sell

When the price broken the upper band, wait the red bar of super trader indicator confirmed by Haos visual with yellow line below green line or confirmed by SSRC below SSRC MTF.

Note: When you are trading in one direction and the price of a signal touches the targetprofit, the counting the martingale, it begins 0.01.

When the last open position reaches the profit, also close earlier opened positions.

Increase profit target of two pips each new open position from the third position open in the same direction.

Example (10 TP 1, TP 2 10, 3 TP 12, TP 14 4, 16 TP 5, TP 6 18).

Close any open position to the opposite signal.

Profit Target 10 pips GBP/USD, 9 pips EUR/USD, 9 pips USD/JPY, 8 pips USD/CHF, AUD/USD, 9 pips EUR/CHF, 9 pips NZD/USD.

No stop loss.

Money management position

Martingale setting:

0.01-0.02-0.04-0.08-0.16- 0.32- 0.64- 1.28 high speculative;

0.01-0.02- 0.03- 0.04-0.07-0.011-0.17-0.27-0.43- 0.8. 1.5 (speculative)

Leverage 400:1 or higher.

Minimum account 1500$ for 0.01 microlot.

This system is a good idea for an EA, I hope some programmer do EA and share it here.

In the pictures MA Bands Martingale Trading.

0 comments:

Post a Comment