Untuk bisa dengan mudah atau dalam bahasa lebih kerenya menjadi seorang ahli, kita di tuntut untuk belajar, memahami, membaca (meskipun berulang2 sampai dapat memahami), meganalisa dan mencoba. Tidak ada sebuah keahlian dilakukan dengan INSTANT, semua membutuhkan proses, waktu dan disinilah dalam berproses inilah yang sering kita abaikan, banyak yang menempuh jalan pintas dan disitulah faktor resiko untuk salah lebih tinggi karena kebanyakan kita akan menggampangkan dan selalu menjadi follower dan bukan leader.

Sebenarnya tidak ada yang salah dalam proses kita belajar, apabila banyak menemukan kendala, kesalahan karena disitulah kunci untuk kita menjadi lebih berpengalaman. Semua teknik saya rasa sudah sangat bagus, tinggal pada diri seorang traderlah yang menyesuaikan dengan system mana, teknik bagaimana kita akan survive di dunia forex,

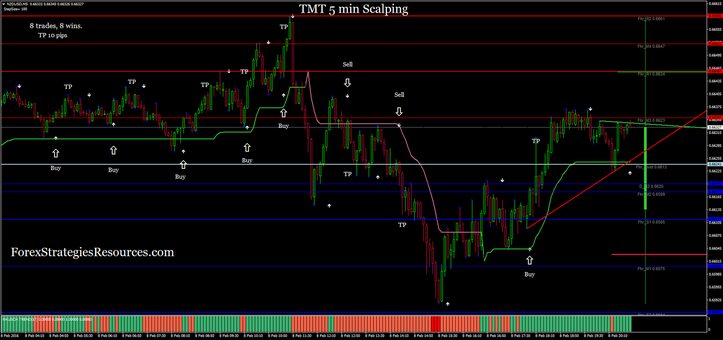

Dengan menggunakan sebuah tool di MT4 ini saya rasa kita sudah bisa survive dalam berbisnis forex, tools ini sangat lengkap dan mudah di pelajari, bisa menggunakan 1 tools saja, apakah fibo retracement, expansion, expansion, fan ataupun kita gunakan secara lengkap (fibonacci cluster).

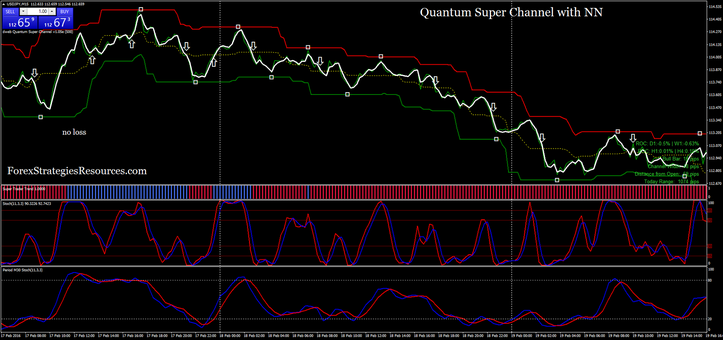

contoh fibo timezone untuk analisa tren dan perubahan arah tren

|

| Fibonacci Timezone |

|

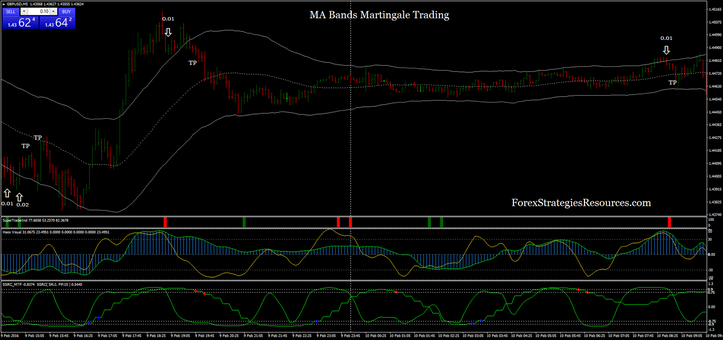

| Fibonacci Retracement & Expansion |

|

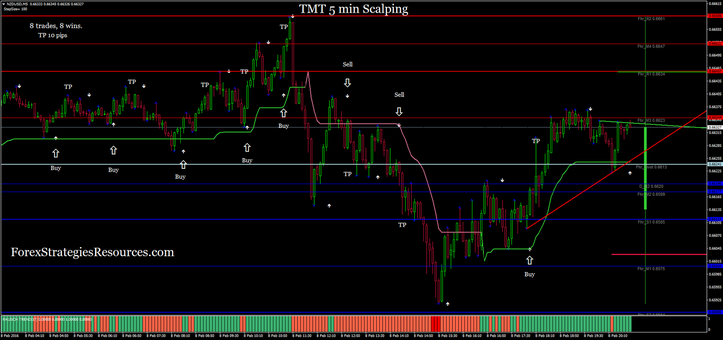

| Fibonacci Fan |

Belajar, memahami, menganalisa strategi, mencoba, temukan error itu lebih berharga daripada membully (membuang energi) sebuah teknik yang kurang cocok dengan gaya trader anda. semakin berpengalaman, waktu akan menjawab, anda akan menjadi seorang leader dalam berbisnis forex.

Dan tunjukkan keberhasilanmu kepada orang yang anda cintai (keluarga / orang tua), simpan dan rahasiakan. jangan anda tunjukkan pada khalayak, karena disitullah awal menjadi orang yang tinggi hati, tetaplah seperti padi, makin banyak berilmu (berisi) semakin merunduk. Apabila anda sudah mennjadi seorang ilmu, bagikan kepada yang memerlukan, lebih baik berguna bagi siapa saja yang ingin menimba ilmu daripada berguna untuk sebagian orang saja.

Dan tunjukkan keberhasilanmu kepada orang yang anda cintai (keluarga / orang tua), simpan dan rahasiakan. jangan anda tunjukkan pada khalayak, karena disitullah awal menjadi orang yang tinggi hati, tetaplah seperti padi, makin banyak berilmu (berisi) semakin merunduk. Apabila anda sudah mennjadi seorang ilmu, bagikan kepada yang memerlukan, lebih baik berguna bagi siapa saja yang ingin menimba ilmu daripada berguna untuk sebagian orang saja.